Abstract:

Many older adults struggle to meet their daily expenses, but persons of color have amplified risk of economic insecurity. In this article, by situating older adults in their geographic locations of residence, we discuss how life-course experiences intersect with aspects of older people’s communities to produce disparities in experiencing precarious financial situations. Race-based risks and disadvantages that accumulate over time yield racial disparities in income among older adults. Taking into account local cost of living reveals substantial disparities in economic security by race. Disparities are far greater in some states than in others.

Key Words:

economic security, precarious aging, Elder Index, spatial disparity, inequality

Many older adults experience challenging financial circumstances that affect their everyday lives and experiences of health and well-being. Half of people ages 65 or older who live alone do not have enough income to afford a basic budget in their home communities, and nearly one in four older couples face the same problem (Mutchler, Li, and Velasco Roldán, 2019). Far higher percentages of Black, Latino, and Asian older adults live on incomes that fall short of what it takes to get by relative to their White counterparts. Older people living in these circumstances must make difficult choices to make ends meet, often facing great uncertainty with respect to their ability to maintain stable housing or secure needed healthcare.

In this article we describe racial and ethnic disparities in economic insecurity in later life, which occurs when an older person lacks sufficient financial resources to cover necessary expenses in the community in which they live. Disparities in economic insecurity reflect the precarious financial situations experienced by many older adults, rooted not only in risks and disadvantages accumulated over time, but also in the variable and uncertain social and economic contexts that accompany the aging experience (Grenier et al., 2017). We focus on the disparities as they are experienced within the communities in which people live. By situating older adults in their places of residence, we observe that the cost of remaining in one’s community—often framed as “aging in place”—intersects with life-course experiences and social identities to produce disparities in economic security at older ages.

Later-life economic insecurity stems from experiences across the life course, including features of work and career that impact retirement income, health status that conditions one’s ability to generate employment income in later life, and family factors relating to marital history and the intergenerational transfer of wealth. People with personal histories of disadvantage and uncertainty are at higher risk of having low incomes in later life. In addition, systemic racism and gaps in policies meant to promote inclusion and equity amplify the risk of insecurity among older persons of color. For example, language barriers to learning about support services can stand in the way of accessing benefits meant for low income older adults.

Contributing to the experience of economic insecurity among older people is the high cost of living in many communities, a result of the spiraling and largely unchecked costs of housing and healthcare, which differ substantially across locations both across and within states (Mutchler and Li, 2021). The geographic variation in cost of living calls for context-specific assessment of economic security to evaluate the adequacy of economic resources and the associated risk of hardship. A place-based analysis that situates people in the locations within which they live reveals sizable racial and ethnic disparities in economic insecurity across geographic settings.

How Much Does It Take to Get By?

Economic insecurity occurs when necessary expenses for housing, food, healthcare, and other essentials exceed the economic resources available to pay for them (Mutchler, Li, and Xu, 2018). It reflects an imbalance between the cost of necessities in an older person’s community and the resources available to them, which may include Social Security benefits, pensions, and income from employment or other sources. Older people who struggle financially may skip needed medical care, live in unhealthy conditions, fall behind in rent or housing payments, or go without nutritious food (Short, 2005). To the extent that the risk of economic insecurity is structured by race, these outcomes inform our understanding of the implications of racial inequality for well-being in later life.

‘The geographic variation in cost of living calls for context-specific assessment of economic security.’

We conceptualize economic insecurity based on the Elder Index, which measures the income older adults need to get by and live independently without relying on means-tested income support programs, loans, or gifts. The Index is calculated annually county-by-county for the United States (Elder Index, 2020). The Elder Index focuses on households that include one or two adults ages 65 or older living independently, capturing approximately two-thirds of all U.S. individuals ages 65 or older. Households including people younger than age 65 or made up of three or more people are not included in the analysis. Expenditures for housing (including utilities), food, transportation, healthcare, and miscellaneous essentials (e.g., cleaning supplies) are included in the Elder Index (see Mutchler, Li, and Xu, 2018).

Elder Index values are calculated for counties, metropolitan areas, states, and for the nation as a whole, offering the opportunity for multiple types and levels of place-based comparisons. The national values of the Elder Index indicate that, on average, an older person living alone in good health requires $21,012, yearly, to get by if they own a home without mortgage, more than $25,000 if they rent a one-bedroom apartment, and more than $32,000 if they have a mortgage (see Table 1, below).

The Index indicates that older couples require about $10,000 more than a single person per year in the same housing scenario, after accounting for economies of scale for two-person households. For all living situations, the Elder Index is far higher than the Federal Poverty Line (FPL), which in 2019 was just $12,490 for a person living alone and $16,910 for a two-adult household (Department of Health and Human Services, 2019). In addition to being far too low to reflect sufficiency, the FPL is largely invariant with respect to geographic location, with the same threshold being used in every location throughout the continental United States, neglecting the substantial variability in cost of living. Accordingly, the share of people who are struggling financially is vastly understated by assessments using the FPL, especially in high-cost areas of the country.

The Elder Index for the United States, 2019 |

||||||

| Older Person | Older Couple | |||||

|

Expense |

Owner without Mortgage | Renter | Owner with Mortgage | Owner without Mortgage | Renter | Owner with Mortgage |

| Housing | $548 | $915 | $1,469 | $548 | $915 | $1,469 |

| Food | $257 | $257 | $257 | $471 | $471 | $471 |

| Transportation | $259 | $259 | $259 | $399 | $399 | $399 |

| Healthcare | $395 | $395 | $395 | $790 | $790 | $790 |

| Miscellaneous | $292 | $292 | $292 | $442 | $442 | $442 |

| Elder Index per month |

$1,751 | $2,118 | $2,672 | $2,650 | $3,017 | $3,571 |

| Elder Index per year |

$21,012 | $25,416 | $32,064 | $31,800 | $36,204 | $42,852 |

Source: The Elder Index, 2019.

Racial and Ethnic Disparities in Economic Insecurity

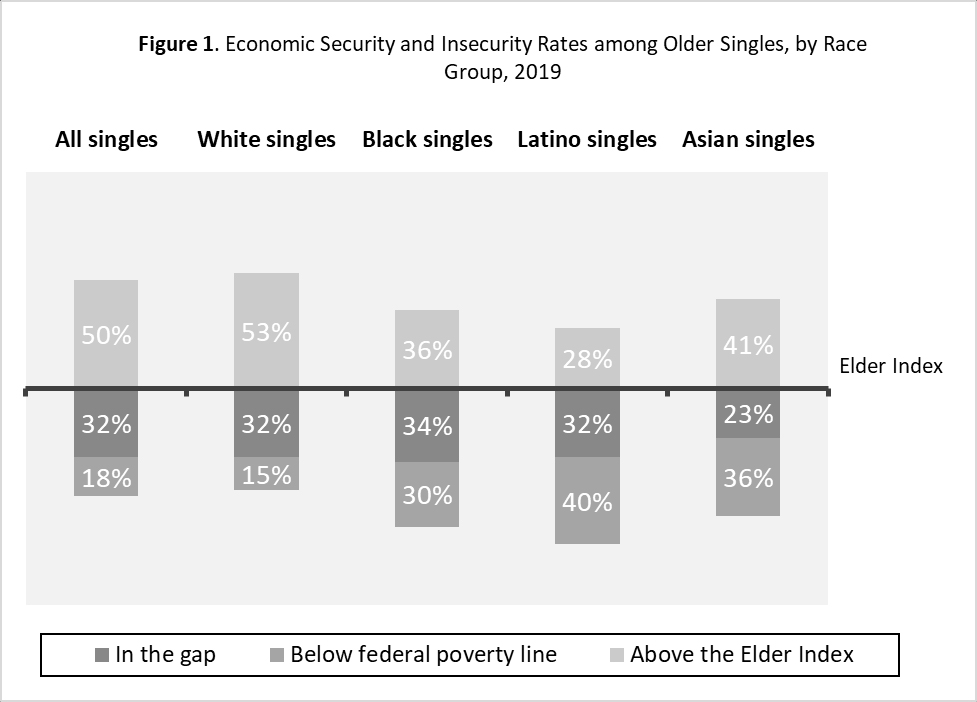

Comparing incomes to the Elder Index yields an understanding of how many older people are economically insecure. Some older people have incomes below the FPL, including 18 percent of older adults living alone (see Figure 1, below). But many more people live “in the gap,” having incomes that fall above federally established thresholds of poverty, yet below the value of the Elder Index, including 32 percent of older adults living alone (Figure 1). These individuals “in the gap” are missed in conventional poverty statistics, despite experiencing a challenging and uncertain existence—having incomes that are too high to be eligible for many needs-based benefits anchored on and around the FPL, but too low to make ends meet and remain independent.

Note: Whites, Blacks, and Asians include only those who are not Latino. Latino are of any race. “All” includes aforementioned groups, plus those who are Native American or Alaska Native, some other race, and those who report multiple races.

Economic insecurity is especially high among older persons of color. Among people ages 65 or older who live alone, half have incomes below the Elder Index (See Figure 1, above). Based on the Elder Index, persons of color who live alone are far more likely to experience economic insecurity, and rates are higher for single Blacks (64 percent), Latinos (72 percent), and Asians (59 percent) than among non-Hispanic Whites (47 percent).

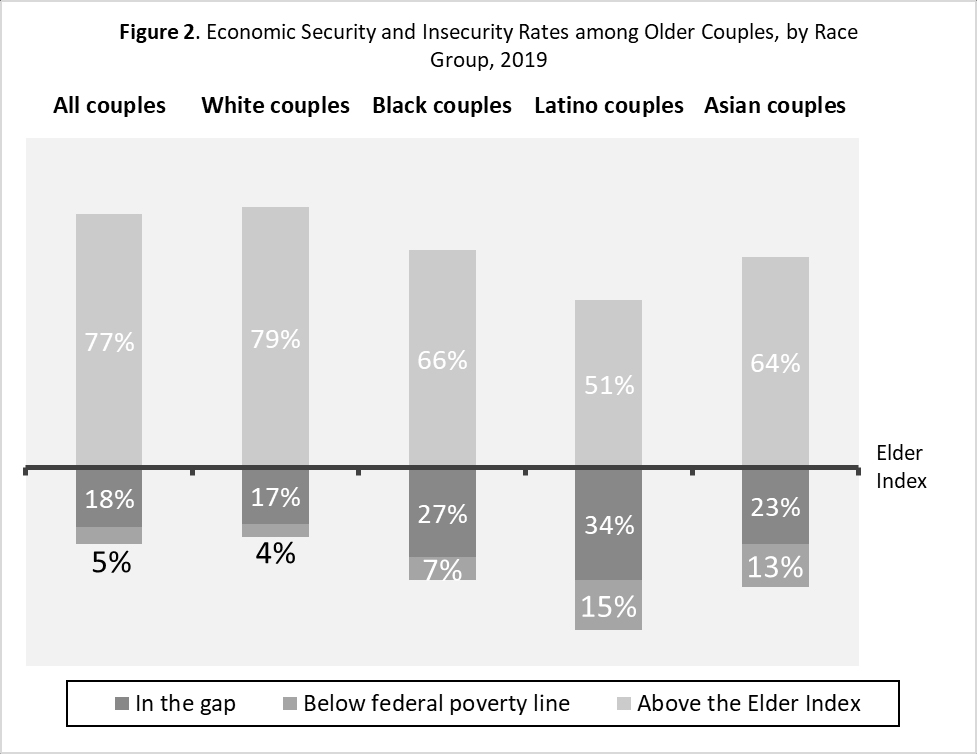

Older couples are less likely than singles to be economically insecure, with 23 percent living with incomes below the Elder Index (see Figure 2, below). Yet racial disparities are substantial for couples as well, and economic insecurity is far higher among Black (34 percent), Latino (49 percent), and Asian (36 percent) couples, compared to 21 percent among non-Hispanic White couples.

Considering older singles and couples together, these estimates suggest that an estimated 11 million adults ages 65 or older struggle to make ends meet, and a disproportionate share of these people are persons of color.

Note: Whites, Blacks, and Asians include only those who are not Latino. Latino are of any race. “All” includes aforementioned groups plus those who are Native American or Alaska Native, some other race, and those who report multiple races. Racial classification of couples is based on the race reported by the householder within the two-person household.

Racial Disparities in Economic Insecurity Are Amplified by Spatial Disparities

Geographic differences in the cost of living determine how much it costs to live independently, contributing to older people’s risk of experiencing economic insecurity. Although nationwide half of older singles who live alone have incomes below the Elder Index, 62 percent of singles have incomes below the Elder Index in Massachusetts, with rates nearly as high in New York (60 percent), Vermont (57 percent), Mississippi (57 percent), and Maine (56 percent). Far lower insecurity rates are estimated in states in the West and Midwest, with the lowest rate in Nevada (41 percent) (Mutchler, Li, and Velasco Roldán, 2019).

Compared to Whites, persons of color have higher rates of economic insecurity in nearly every state, but disparities are higher in some locations. Rates among older Black singles are as high as 80 percent in Rhode Island, and more than 70 percent in Massachusetts, Mississippi, Louisiana, and South Carolina (see Table 2, below). States with the highest levels of economic insecurity among older Blacks are in the Deep South or the Northeast, generally reflecting areas with particularly low income or high living costs, consistent with where high economic insecurity rates for other groups are seen. States with the lowest rates of insecurity among single Blacks include Oregon, Arizona, Washington, Nevada, and West Virginia, but even in these states, at least 46 percent of single Blacks are economically insecure.

‘Compared to Whites, persons of color have higher rates of economic insecurity in nearly every state.’

Comparing economic insecurity rates across racial groups in the same state shows that disparities in economic insecurity are amplified in states where the percentage of Black singles living below the Elder Index is highest. In the five states with the highest rates of economic insecurity among Black singles, the difference between Blacks and Whites is as much as 29 percent (see Table 2, below), indicating that in these states older Blacks encounter not only a very high risk of struggling financially, but also experience elevated disadvantage relative to their White counterparts. Rates of economic insecurity are still high in the five states with the lowest levels of economic insecurity, but in these states the gap in economic insecurity rates between Blacks and Whites is far less, highlighting the variable spatial context of racial disparities in economic security. Disparities between Latino, Asian, and non-Hispanic White older adults also are sizable, and vary widely from state to state (for details, see Mutchler, Velasco Roldán, and Li, 2020).

Table 2. Percentage with Income Below the Elder Index, Singles Ages 65 and Older, 2019 |

|||

| States with highest rates of economic insecurity among Blacks | Black or African American | White, non-Hispanic |

Disparity |

| Rhode Island | 80% | 51% | 29% |

| Massachusetts | 76% | 58% | 18% |

| Mississippi | 74% | 48% | 26% |

| Louisiana | 71% | 48% | 23% |

| South Carolina | 70% | 44% | 26% |

| States with lowest rates of economic insecurity among Blacks | |||

| Oregon | 53% | 48% | 5% |

| Arizona | 53% | 41% | 12% |

| Washington | 49% | 47% | 2% |

| Nevada | 47% | 38% | 9% |

| West Virginia | 46% | 51% | -5% |

| U.S. Average | 64% | 47% | 17% |

Source: Authors’ calculation based on data from the Elder Index (2019) and American Community Survey (2014-2018, retrieved from Ruggles et al., 2020).

Living Below the Line

Economic insecurity is a permanent feature of many people’s lives, and disparities in economic security reflect the high levels of racial inequality present in the United States. For many older people, especially persons of color, financial uncertainty is routinely experienced, along with vacillating risk of financial shortfalls based on loss of employment, loss of a spouse, increasing medical expenses, or retrenchment in policies and programs that serve to bridge financial needs (Angel, Jimenez, and Angel, 2007; Van Horn, Corre, and Heidkamp, 2011). These later life circumstances can limit people’s ability to pursue an independent lifestyle and age safely and securely in the community and the places they live.

Place-based racial and ethnic disparities in late-life economic insecurity reflect discrimination and systemic racism throughout the life course. Early in life, patterns of structural disadvantage yield poorer access to higher education for people of color, especially for those who are Black or Latino, and elevated likelihood of holding low-wage or unstable jobs with fewer benefits. Black workers are less likely to hold jobs in which an employer offers a retirement plan, and they are less likely during their work lives to have earnings adequate to support participation in an IRA account (Carr, 2019). As a result of disparities in work and health trajectories, people of color are at higher risk of entering later life with few financial resources, little wealth, and little or no pension income (Carr, 2019; Tamborini and Kim, 2020). These experiences differ geographically as they intersect with locations of disadvantage and spatially variable institutional context, potentially affecting where people live and age (Grenier et al., 2017).

The impacts of migration also are interconnected with observed disparities. Many older persons of color in the United States are immigrants, especially among those who are Asian or Latino, exposing them to additional layers of structural disadvantage. For example, nearly nine out of ten Asian Americans ages 65 or older, and more than half of their older Latino counterparts, were born outside the United States (Mutchler, Velasco Roldán, and Li, 2020).

Although many older immigrants have lived in the United States for decades, a sizable share arrived at an older age and some may not have worked in this country long enough to be eligible for Social Security benefits. Others have been locked into low-wage seasonal jobs, impacting their ability to receive Social Security benefits. The typical older Black or Latino family receives annual benefits of about 24 percent lower than what the typical non-Hispanic White family receives (Waid, 2016). Geographic differences in work opportunities, average pay rates, and minimum wage values in the states and communities where Social Security credits are accumulated further contribute to these disparities.

‘The impacts of migration are also interconnected with the observed disparities.’

Before the COVID-19 pandemic, many older adults already faced precarious financial circumstances, struggling to meet basic expenses of food, housing, and healthcare (Mutchler, Li, and Velasco Roldán, 2019). Although the economic fallout associated with the pandemic has been felt across the demographic spectrum, segments of the older population have been especially hard hit (Li and Mutchler, 2020). Older blacks were experiencing increasing food insecurity on top of persistent gaps even before the pandemic (Ziliak, 2020), and Black and Latino people report far less confidence in their ability to make the next mortgage or rent payment, compared to Whites (Scheckler and Airgood-Obrycki, 2020).

Also, older Black and Hispanic adults were more likely to be financially fragile during the pandemic relative to their White counterparts, as indicated by their inability to meet a $2,000 emergency situation within one month (Clark, Lusardi, and Mitchell, 2020). Recent events reflect the persistent racial gaps in financial well-being among older adults in the United States, but also illustrate how the pandemic renders many older adults who already live “on the edge” even more vulnerable to financial and health risks.

Conclusion and Remedies

Many older people struggle to get by financially, and the chances of experiencing economic insecurity are elevated for persons of color. Half of older adults who live alone struggle to make ends meet, with rates even higher among Blacks, Latinos, and Asians. Couples experience lower risks of economic insecurity than singles, but racial and ethnic disparities are sizable for them as well. Features of the spatial context contribute to insecurity by shaping how much it costs to age in community, but the cost of living is seldom considered in assessments of financial well-being in later life. When living expenses are factored in, rates of economic insecurity are far higher in some areas of the country than in others, reflecting differences in cost of living and in the distribution of later-life incomes across populations and places. These high and disparate risks translate to precarious living circumstances, including risk of housing displacement, irregular healthcare, and inadequate nutrition among older people, particularly older persons of color.

Stabilizing financial circumstances in later life requires addressing the inequitable systems and racist practices that shape the accumulation of resources throughout the life course, from childhood through later life. Investing in equal access to and quality of education, ensuring fair opportunities to secure well-paying and stable employment, and promoting financial literacy about attaining a secure retirement can contribute to more equitable experiences in retirement. People who continue to work into later ages are able to prolong the time during which they generate income, and delay drawing on their savings. Plus, waiting to start receiving Social Security results in higher monthly benefits, strengthening economic security (Munnell and Walters, 2019).

Yet for many people, continuing to work in later life is no easy task. It may not be a realistic option for people with work-limiting health or disabling conditions to remain in the workforce, and older people of color on average experience earlier onset of such conditions. Additionally, age discrimination is a barrier for many people seeking to remain employed or return to employment. Notably, age discrimination may be amplified among older women (Burn et al., 2020), and among racial and ethnic minorities (Delaney and Lahey, 2019). Given that types of jobs and industries, levels of discrimination, and social investments in human capital differ across U.S. states and communities, it is not surprising that disparities in later-life financial well-being also differ across geographic locations.

Several interventions could pave the way for addressing economic security among older people. As the foundations of a secure retirement for millions of Americans, Social Security and Medicare must be protected and strengthened. These programs are especially essential in promoting retirement security among older persons of color, who rely more heavily on them than do their White counterparts (Hou and Sanzenbacher, 2020; see also this issue). Reducing the cost of housing and healthcare is necessary to safeguard economic security in later life, as they represent the biggest components of older Americans’ budgets. In addition, it is necessary to build culturally and linguistically inclusive strategies to promote awareness of and access to programs that help bridge the gap between financial resources and essential expenses, such as SNAP (Supplemental Nutrition Assistant Program, or food stamp) benefits, housing subsidies, and fuel assistance.

A place-based analysis that situates individuals within their geographic locations reveals how racial and ethnic disparities intersect with spatial disparities in economic insecurity at older ages, providing a nuanced reflection of the precarious financial situations many older people experience. These intersecting patterns of disparities stem from not only risks and disadvantages accumulated over the life course, but also the variable social and economic contexts that accompany the aging experience, rendering visible the risks and uncertainties carried into later life. The realities of living with insufficient economic resources among many older people, especially older people of color, are manifested through not only experienced hardship such as food insecurity and delayed or skipped medical care, but also adverse health and social consequences. These realities serve as a reminder of the structural inequalities in our society, and underscore the importance of sustained social commitments, services, and protections to help vulnerable people age in place with dignity, especially in times of crisis during which already precarious situations are exacerbated, and inequalities compounded.

Acknowledgements: We acknowledge with appreciation the support of the RRF Foundation for Aging, the National Council on Aging, The Silver Century Foundation, The Henry and Marilyn Taub Foundation, and the Gary and Mary West Foundation. Thanks also to our UMass Boston colleagues Len Fishman and Marc Cohen, and to members of the Elder Index Strategy Group.

Jan E. Mutchler, PhD, is a professor in the Department of Gerontology and director of the Center for Social and Demographic Research on Aging in the Gerontology Institute at the University of Massachusetts Boston. She can be reached at Jan.Mutchler@umb.edu. Yang Li, MS, and Nidya Velasco Roldán, MS, are both doctoral candidates in the Department of Gerontology and research assistants in the Center for Social and Demographic Research on Aging in the Gerontology Institute at the University of Massachusetts Boston.

References

Angel, J. L., Jimenez, M. A. and Angel, R. J., 2007. “The Economic Consequences of Widowhood for Older Minority Women.” The Gerontologist 47(2): 224-34.

Burn, I., et al. 2020. “Why Retirement, Social Security, and Age Discrimination Policies Need to Consider the Intersectional Experiences of Older Women.” Public Policy & Aging Report 30(3): 101-6.

Carr, D. 2019. Golden Years? Social Inequality in Later Life. New York: Russell Sage Foundation.

Clark, R. L., Lusardi, A., and Mitchell, O. S. 2020. “Financial Fragility During the COVID-19 Pandemic.” NBER Working Paper No. w28207. National Bureau of Economic Research. Retrieved February 1, 2021.

Delaney, N. and Lahey, J. N. 2019. “The ADEA at the Intersection of Age and Race.” Berkeley Journal of Employment & Labor Law 40(1): 61-90.

Department of Health and Human Services. 2019. “2019 Poverty Guidelines.” Retrieved February 1, 2021.

Elder Index. 2020. The Elder Index. Boston, MA: Gerontology Institute, University of Massachusetts Boston. Retrieved February 1, 2021.

Greiner, A., et al. 2017. “Precarity in Late Life: Understanding New Forms of Risk and Insecurity.” Journal of Aging Studies 43: 9-14.

Hou, W., and Sanzenbacher, G. T. 2020. Social Security is a Great Equalizer. Issue Brief 20-2. Chestnut Hill, MA: Center for Retirement Research at Boston College.

Li, Y., and Mutchler, J. 2020. “Older Adults and the Economic Impact of the COVID-19 Pandemic.” Journal of Aging & Social Policy 32(4-5): 477-87.

Munnell, A.H., and Walters, A. N. 2019. “Proposals to Keep Older People in the Labor Force.” Retrieved February 2, 2021.

Mutchler, J., and Li, Y. 2021. “Aging in the 100 Largest Metropolitan Areas: How Do Older Adults Fare?” Retrieved April 25, 2021.

Mutchler, J., Li, Y., and Xu, P. 2018. “How Strong Is the Social Security Safety Net? Using the Elder Index to Assess Gaps in Economic Security.” Journal of Aging and Social Policy 31(2): 123-37.

Mutchler, J., Li, Y., and Velasco Roldán, N. 2019. “Living Below the Line: Economic Insecurity and Older Americans, Insecurity in the States 2019.” Retrieved January 2, 2021.

Mutchler, J., Velasco Roldán, N., and Li, Y. 2020. “Living Below the Line: Racial and Ethnic Disparities in Economic Security among Older Americans, 2020.” Retrieved January 2, 2021.

Ruggles, S., et al. 2020. IPUMS USA: Version 10.0 [Public Dataset]. Minneapolis, MN: IPUMS. https://doi.org/10.18128/D010.V10.0.

Scheckler, S., and Airgood-Obrycki, W. 2020. “Making Rent in the Pandemic: How Are Older Adult Households Faring?” Retrieved January 5, 2021.

Short, K. S. 2005. “Material and Financial Hardship and Income-Based Poverty Measures in the USA.” Journal of Social Policy 34(1): 21-38.

Tamborini, C. R. and Kim, C. 2020. “Are You Saving for Retirement? Racial/Ethnic Differentials in Contributory Retirement Savings Plans.” The Journals of Gerontology: Social Sciences 75(4): 837-48.

Van Horn, C.E., Corre, N. and Heidkamp, M., 2011. “Older Workers, the Great Recession, and the Impact of Long-term Unemployment.” Public Policy & Aging Report 21(1): 29-33.

Waid, M. 2016. “Social Security: A Key Retirement Source for Older Minorities.” Retrieved December 15, 2021.

Ziliak, J. P. 2020. “Food Hardship During the Covid‐19 Pandemic and Great Recession.” Applied Economic Perspectives and Policy. Retrieved February 1, 2021.