Abstract:

Under Medicare, older Americans have access to government-subsidized health insurance to protect them from catastrophic healthcare costs and ensure access to needed care. And yet, one in ten Medicare beneficiaries report delaying care due to cost, and 6 percent report having problems paying medical bills. The health and economic impacts of the coronavirus pandemic have exacerbated issues of healthcare affordability for older adults, particularly those with low incomes. This article reviews the financial impact of gaps in the Medicare program, and proposals designed to meet Medicare beneficiaries’ evolving needs.

Keywords:

Medicare, health financing, access to care

The Medicare program was established in 1965 in response to high medical costs among older Americans, many of whom did not have access to other insurance options such as employer-sponsored insurance. The Medicare program’s primary objective was to provide financial protection from catastrophic healthcare costs often attributable to hospital stays, and to ensure access to necessary care. Due to significant opposition to publicly funded health insurance at the time, the final signed bill comprised a modest benefit package of inpatient services (Part A) and outpatient services (Part B) that required contributions from beneficiaries in the form of premiums, deductibles, and co-payments, with no limits placed on the maximum out-of-pocket contribution (Blumenthal, Davis and Guterman, 2015).

Medicare’s benefit package did not include other health services used by older adults such as prescription drugs, long-term services and supports, dental, vision, and hearing services. The exclusion of these services can be largely attributed to provider opposition, cost minimization, and an assessment of healthcare priorities for older adults.

At the time of its enactment, the average life expectancy of Americans was age 70, an additional five years of life beyond Medicare eligibility. It is now almost 79 years (Arias and Xu, 2019), and with these additional years of life expectancy have come more time spent with complex health needs. Almost half (47 percent) of current Medicare beneficiaries live with three or more chronic conditions, and a quarter (24 percent) live with functional limitations or cognitive impairment (Davis and Willink, 2020). These complex needs require greater support and monitoring over longer periods of time, translating to higher healthcare costs (Davis and Willink, 2020).

The reality is that Medicare beneficiaries’ needs have evolved more rapidly over the past six decades than has the Medicare program. While there have been some changes to the Medicare benefit package, such as the voluntary prescription drug benefit (Part D), substantial gaps in the program remain. The lack of significant benefit changes has contributed to greater financial stress for all older adults, but particularly for those with more limited economic resources.

Medicare’s Benefit Structure Is Dependent Upon Large Contributions From Beneficiaries

In 2021, Medicare beneficiaries enrolled in the traditional Medicare program have an annual Part B premium of $1,782, and Part B deductible of $203, in addition to the 20 percent coinsurance for outpatient services (including physician-administered drugs). For Part A (inpatient) services, Medicare beneficiaries pay a deductible of $1,484 per episode, with daily coinsurance of $371 from days 61-90, and $742 per day thereafter.

For those using skilled nursing facilities there is a daily coinsurance of $185.50 for care that extends beyond 21 days (Centers for Medicare & Medicaid Services [CMS], 2020). Due to the significant cost exposure, the vast majority of Medicare beneficiaries have supplemental insurance in the form of either Medicaid, employer-sponsored insurance, Medigap, or Medicare Advantage. In 2018, only 15 percent of Medicare beneficiaries had the Medicare program as their only health insurance (data not shown).

Gaps in Medicare coverage as a result of cost-sharing related to covered services, as well as the costs of non-covered services, expose Medicare beneficiaries to high out-of-pocket costs and financial barriers to care. This has a particular effect on low-income Medicare beneficiaries, defined here as Medicare beneficiaries with incomes below 200 percent of the Federal Poverty Line (FPL).

In 2018, 40 percent of Medicare beneficiaries had annual incomes below 200 percent of the FPL (equating to $24,086 per year for an individual and $30,386 per year for a couple). Having to pay a hospital deductible of $1,484 per episode as well as other out-of-pocket costs related to doctors and prescription drug fees with a monthly income of $2,007 for a person at 200 percent of the FPL can have serious impacts on the economic stability of older Americans with limited incomes who don’t qualify for additional support.

Gaps in Medicare coverage expose Medicare beneficiaries to high out-of-pocket costs and financial barriers to care.

Medicaid, the government-financed health insurance program for low-income individuals and families, provides varying degrees of cost-sharing support for Medicare beneficiaries with low-incomes through the Medicare Savings Program. Full Medicaid benefits include coverage of Medicare premiums and cost-sharing, as well as coverage of long-term nursing home stays and other services at the discretion of the state. The Qualified Medicare Beneficiary Program (QMB) provides coverage of Medicare Part A and B premiums and cost-sharing only for beneficiaries with incomes up to 100 percent of the FPL, and the Specified Low-Income Medicare Beneficiary and Qualifying Individual programs cover Part B premiums for those with incomes up to 120 percent and 135 percent of the FPL, respectively. Medicare beneficiaries who are eligible for Medicaid or the Medicare Savings Programs are automatically eligible for the Part D Low-Income Subsidy program, which provides premium and cost-sharing assistance for beneficiaries with incomes less than 150 percent of the FPL.

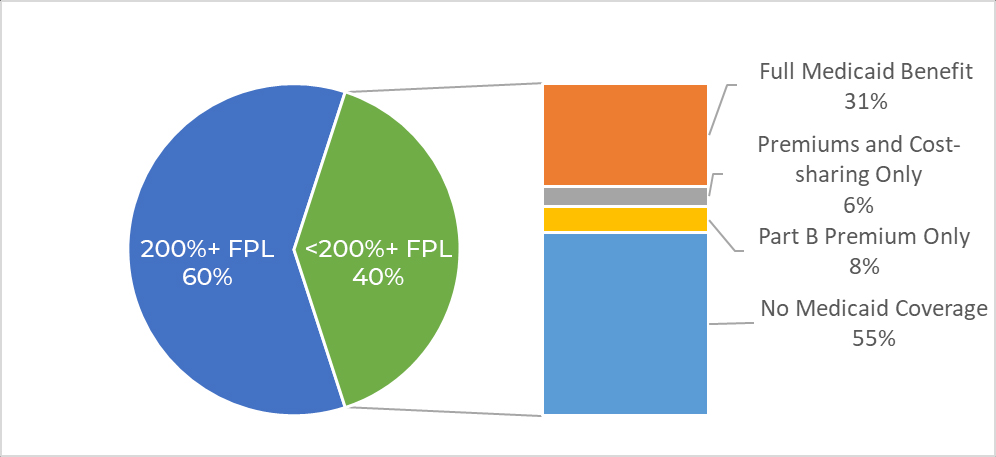

In 2018, among low-income beneficiaries, 31 percent received full Medicaid benefits, including Medicare cost-sharing, 6 percent received Part A and B cost-sharing coverage only, and 8 percent received support with paying the Part B premium only. Yet, it is important to note that more than half of Medicare beneficiaries with annual incomes below 200 percent of the FPL did not receive any Medicaid benefits (see Figure 1, below). These insurance coverage gaps have profound impacts on the lives of some of the nation’s most economically vulnerable older adults, a group that also has, on average, higher rates of chronic and/or disabling conditions. While in some cases this may cause substantial out-of-pocket burden, in others it will lead to delays in access to care.

Figure 1: Income Distribution of Medicare Beneficiaries and Access to Medicaid and the Medicare Savings Program, 2018

Medicare Cost-sharing Impacts Access to Care and Financial Well-being of Beneficiaries

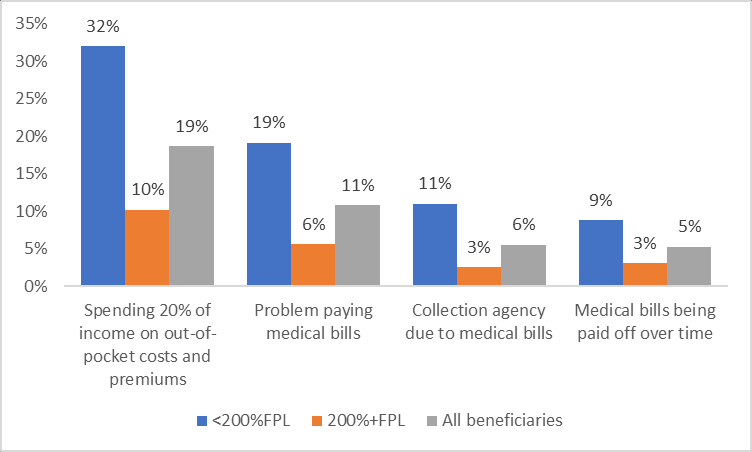

Data from the 2018 Medicare Current Beneficiary Survey, a nationally representative survey of Medicare beneficiaries with linked administrative claims data, reveals that even with the additional support from Medicaid and the Medicare Savings Program, almost a third (32 percent) of beneficiaries with incomes below 200 percent of the FPL reported spending 20 percent of their income on out-of-pocket costs and premiums, compared to only 10 percent who had incomes at or above 200 percent of the FPL (see Figure 2, below).

As a consequence of care costs, 17 percent of low-income older adults delayed necessary medical care in the prior twelve months, and 19 percent reported having problems paying their medical bills. One in ten Medicare beneficiaries had been contacted by a collection agency regarding payment and 9 percent were paying off medical bills over time.

There also may be public costs associated with these burdens borne by individuals, and high out-of-pocket costs in the Medicare program have been shown to accelerate older adults’ entry into the Medicaid program (Keohane, Trivedi, and Mor, 2018; Willink et al., 2019). These findings bring into question the rationale for high cost-sharing as a public savings measure in the Medicare program if it results in higher (or more rapid) enrollment in other publicly funded programs, such as Medicaid, as individuals spend down their assets.

Figure 2: Out-of-pocket Spending and Adverse Consequences Among Medicare Beneficiaries, 2018

Out-of-pocket spending among Medicare beneficiaries is driven by cost-sharing for covered services, and spending on non-covered services such as long-term services and supports, dental, vision, and hearing services (Schoen, Willink, and Davis, 2019). In 2016, out-of-pocket spending among Medicare beneficiaries was split almost equally between cost-sharing for covered services (52 percent) and spending on non-covered services (48 percent) (Schoen, Willink, and Davis, 2019).

Among community-dwelling beneficiaries only, the majority of out-of-pocket spending came from cost-sharing of covered services, particularly medical provider and prescription drug costs. Most of the spending on non-covered services was attributable to dental costs. Importantly, these numbers do not account for the out-of-pocket costs of home- and community-based services such as personal care and meal delivery. While a lot of personal care services are provided by unpaid caregivers, often family or friends, many beneficiaries are spending money on paid caregivers, assistive devices, and household modifications to support living in the community with functional and/or cognitive limitations (Willink et al., 2019). For one in eight older adults who receive paid long-term services and supports, lifetime costs of paid care exceed $250,000 (Favreault, Gleckman, and Johnson, 2015).

Healthcare costs in some cases result in Medicare beneficiaries not receiving or delaying necessary care. In 2018, one in ten Medicare beneficiaries reported delaying care in the past year due to cost, up to 17 percent among low-income beneficiaries (see Table 1, below). Twelve percent of low-income beneficiaries reported that they sometimes or often did not get prescription medications due to cost.

Not receiving necessary care also has been reported for services not covered by Medicare, with reports of financial barriers to care highest among low-income beneficiaries. One in ten low-income Medicare beneficiaries reported not going to the dentist due to cost. In 2015, 29 percent of Medicare beneficiaries living in the community with functional limitations reported a negative consequence as a result of inadequate support with daily activities, such as wetting or soiling oneself because there was no one to help them get to the toilet (Wolff et al., 2019). The costs older people incur impact issues of access, treatment to care, and overall economic security.

Table 1: Barriers to Accessing Care Due to Cost by Income, 2018

| Due to cost… | <200% FPL | 200%+ FPL | All beneficiaries |

| Delayed care in the last year | 17% | 7% | 11% |

| Often or sometimes did not get prescription medication | 12% | 8% | 9% |

| Couldn’t get dental care | 10% | 3% | 6% |

| Couldn’t get vision care among those with vision trouble | 8% | 3% | 5% |

| Couldn’t get hearing care among those with hearing trouble | 6% | 2% | 3% |

Source: Author’s analysis of the 2018 Medicare Current Beneficiary Survey.

Impacts of COVID-19 on Medicare Beneficiaries’ Financial Stress

Among the many adverse consequences of COVID-19, it also has accentuated issues of affordability and financial stress. The impact of the spread of coronavirus and its effect on the health and well-being of Medicare beneficiaries has been widely documented. Reporting from the Centers for Disease Control and Prevention (CDC) between January 2020 and February 2021 show that eight in ten deaths attributable to COVID-19 occurred among adults ages 65 and older (CDC, 2021). It also has had detrimental economic effects on Medicare beneficiaries, with high unemployment rates compared to younger age groups and reduced likelihood of employment reentry (Davis and Willink, 2020). Across the summer of 2020, almost one in five (18 percent) Medicare beneficiaries reported feeling less financially secure (Medicare Current Beneficiary Survey, 2020).

In response to the significant health needs of Medicare beneficiaries during this time, the Coronavirus Aid, Relief, and Economic Security (CARES) Act was on March 27, 2020 signed into law with two important provisions for beneficiaries. First, the CARES Act ensures COVID-19 testing without any beneficiary cost-sharing obligation. However, treatment for COVID-19 in an inpatient or post-acute setting is still subject to the standard cost-sharing requirements for Part A deductibles and co-payments.

Secondly, the CARES Act expanded telehealth services coverage, supporting many beneficiaries’ continued access to necessary care without the increased risk of exposure to coronavirus. Sixty percent of Medicare beneficiaries reported that their usual healthcare provider offered telephone or video appointments, this was slightly lower (54 percent) among beneficiaries with incomes of less than $25,000 a year (Medicare Current Beneficiary Survey, 2020). This also is compounded by the lower levels of access to the internet among lower-income beneficiaries—65 percent among those with incomes less than $25,000, versus 92 percent with internet access among beneficiaries with incomes of $25,000 or more (Medicare Current Beneficiary Survey, 2020).

Policy Proposals to Address Medicare Affordability and Access Challenges

While the COVID-19 pandemic has exacerbated Medicare beneficiaries’ economic insecurity, there were already significant gaps in the program, leaving beneficiaries vulnerable to high care costs. As the needs of Medicare beneficiaries have become more complex and enduring, adjustments to the Medicare program have been limited to the private arm of the Medicare program, Medicare Advantage, which enrolls 39 percent of beneficiaries (Freed, Damico, and Neuman, 2021). These differences pertain to cost-sharing of covered Medicare services as well as including non-covered services.

‘While Medicare Advantage plans have been given the authority to provide non-medical services such as personal care, very few have taken it up.’

Unlike the rest of the Medicare program, Medicare Advantage plans are required to provide an out-of-pocket limit on inpatient and outpatient services, which in 2021 are $7,550 for in-network and $11,300 for in-network and out-of-network services (Freed, Damico, and Neuman, 2021). There have been widespread calls for an out-of-pocket limit to be uniformly placed on the Medicare program. Recent estimates from the Kaiser Family Foundation suggest that introducing an out-of-pocket spending limit of $6,700 per year would impact approximately 2 percent of beneficiaries in the traditional Medicare program, who would save, on average, $2,727 each (Cubanski et al., 2020). Lower thresholds for the out-of-pocket spending limit have been proposed with varying implications for the population affected and costs to the Medicare program (Cubanski et al., 2020; Schoen, Davis, Buttorff, and Willink, 2018).

Other proposals have included shifting the Part A deductible to a co-payment per admission. As high out-of-pocket spending for many Medicare beneficiaries is a consequence of the Part A deductible that is applied per episode, introducing a modest co-payment of $100 or $350 per admission would substantially reduce the risk of catastrophic spending among beneficiaries (Schoen, Davis, Buttorff, and Willink, 2018).

Another cause of high spending among Medicare beneficiaries is prescription drugs, with beneficiaries now spending more out-of-pocket on prescription drugs than on doctor’s visits and hospital services (Schoen, Willink, and Davis, 2019). The Elijah E. Cummings Lower Drug Costs Now Act (H.R. 3), which passed in 2019 in the House, proposed an out-of-pocket limit for Part D prescription drugs of $2,200 per year. There are more than a million Medicare beneficiaries who spend more than the current catastrophic spending threshold of $3,200 per year (Cubanski et al., 2020).

As low-income older adults are at particular risk of experiencing financial stress due to high out-of-pocket costs, making targeted changes to the Medicare Savings Program by increasing the income eligibility threshold of the Medicare Savings Program could provide more low-income older adults with premium and cost-sharing support. In addition, aligning the Medicare Savings Program with the income eligibility thresholds of the Part D Low-Income Subsidy would substantially reduce the administrative burden of these separate programs (Schoen, Davis, Willink, and Buttorff, 2018).

Medicare Advantage plans also are distinct from the traditional Medicare program in that these plans can provide supplemental medical and non-medical benefits paid for through additional premiums or rebate dollars (Willink and DuGoff, 2018). In 2020, 79 percent of Medicare Advantage plans offered eye exams and glasses and 39 percent offered meal benefits, which are not in the standard Medicare benefit package (Freed et al., 2021). While Medicare Advantage plans have been given the authority to provide non-medical services such as personal care, very few have taken it up. This may be due to concerns of adverse selection, that sicker beneficiaries will enroll in these private plans and increase overall costs (Willink and DuGoff, 2018).

While changes to the Medicare Advantage program may offer insights into the demand and costs of these traditionally non-covered services, studies suggest that these coverage options may not provide sufficient financial protection to make an impact on access to care. Medicare Advantage enrollees with plans covering dental services in 2017 still paid 70 percent of dental costs out-of-pocket (Willink et al., 2020).

Effectively addressing the gaps in Medicare that expose beneficiaries to high out-of-pocket costs requires changes to the standard Medicare benefit package that affect those enrolled in the traditional program or in Medicare Advantage. Many experts in this field have proposed different approaches to providing and paying for long-term services and supports, ranging from back-end catastrophic coverage to front-end personal care benefits (Cohen, Feder, and Favreault, 2018; Davis, Willink, and Schoen, 2016; Favreault, Gleckman, and Johnson, 2015).

Similarly, there have been many bills introduced to the U.S. Congress over time to expand Medicare benefits to include dental, vision, and hearing services (Willink et al., 2020). While studies have shown there are cost savings to be made from addressing non-medical needs (Nasseh, Vujicic, and Glick, 2016; Willink, Reed, and Lin, 2019; Wolff et al., 2019), translating the Medicare program from a reactive program to a proactive program by expanding these benefits would require significant investment at a time of deep economic uncertainty. Recently, the Congressional Budget Office (CBO) revised the outlook on the Medicare Hospital Insurance (Part A) Trust Fund down to only three years remaining until insolvency. Congress has identified opportunities for significant savings, including the negotiation of prescription drugs by Medicare, which the CBO estimated would generate $46 billion in savings over the 2020 to 2029 period to the Medicare program (Swagel, 2019). The issue of Medicare’s financial sustainability must be addressed by the current Congress, which should consider the issue of affordability for beneficiaries as well.

Conclusion

The U.S healthcare system is at an important juncture as the COVID-19 pandemic magnifies its gaps and flaws. These gaps leave Medicare beneficiaries, particularly lower income beneficiaries, vulnerable to high out-of-pocket healthcare costs that in too many cases result in debts accruing with debt collection agencies, delays in accessing care, and risk of entry into Medicaid.

Returning to Medicare’s original objective of providing financial protection and ensuring access to necessary care will require an awareness and appreciation for the evolving needs of Medicare beneficiaries in the twenty-first century, a diverse population—demographically, economically, and in health status.

Amber Willink, PhD, is an associate professor at the Menzies Centre for Health Policy and Economics, University of Sydney, in Australia, and in the department of Health Policy and Management at Johns Hopkins University, Baltimore, Maryland. She may be reached at amber.willink@sydney.edu.au.

References

Arias, E., and Xu, J. 2019. “United States Life Tables, 2017.” National Vital Statistics Reports 68: 7. Retrieved April 26, 2021.

Blumenthal, D., Davis, K., and Guterman, S. 2015. “Medicare at 50—Origins and Evolution.” New England Journal of Medicine 372(5): 479-86.

Centers for Medicare & Medicaid Services (CMS). 2020. 2021 Medicare Parts A & B Premiums and Deductibles November 6. Retrieved February 3, 2021.

Centers for Disease Control and Prevention. 2021. Weekly Updates by Select Demographic and Geographic Characteristics. Retrieved February 11, 2021.

Cohen, M., Feder, J., and Favreault, M. 2018. “A New Public-private Partnership: Catastrophic Public and Front-end Private LTC Insurance.” Boston, MA: LeadingAge LTSS Center@ UMass Boston. Washington, DC: Urban Institute. Retrieved January, 22, 2019.

Cubanski, J., et al. 2020. “Options to Make Medicare More Affordable For Beneficiaries Amid the COVID-19 Pandemic and Beyond.” San Francisco, CA: Kaiser Family Foundation. Retrieved April 26, 2021.

Davis, K., and Willink, A. 2020. “COVID-19 and Affordability of Coverage and Care for Medicare Beneficiaries.” Commonwealth Fund Issue Brief. Retrieved April 26, 2021.

Davis, K., Willink, A., and Schoen, C. 2016. “Medicare Help at Home.” Health Affairs, April 13, 2016. Retrieved April 26, 2021.

Favreault, M. M., Gleckman, H., and Johnson, R. W. 2015. “Financing Long-Term Services and Supports: Options Reflect Trade-Offs for Older Americans and Federal Spending.” Health Affairs 34(12): 2181-91. https://doi.org/10.1377/hlthaff.2015.1226.

Freed, M., Damico, A., and Neuman, T. 2021. A Dozen Facts About Medicare Advantage in 2020. Kaiser Family Foundation. Retrieved February 2, 2021.

Keohane, L. M., Trivedi, A. N., and Mor, V. 2018. “The Role of Medicare’s Inpatient Cost-Sharing in Medicaid Entry.” Health Services Research 53(2): 711-29. https://doi.org/10.1111/1475-6773.12682.

Medicare Current Beneficiary Survey. 2020. COVID-19 Experiences Among the Medicare Population. Retrieved April 26, 2021.

Nasseh, K., Vujicic, M., and Glick, M. 2016. “The Relationship Between Periodontal Interventions and Healthcare Costs and Utilization. Evidence from an Integrated Dental, Medical, and Pharmacy Commercial Claims Database.” Health Economics 26(4): 519-27. https://doi.org/10.1002/hec.3316.

Schoen, C., Davis, K., Buttorff, C., and Willink, A. 2018. “Medicare Benefit Redesign: Enhancing Affordability for Beneficiaries While Promoting Choice and Competition.” Commonwealth Fund Issue Brief, October 28, 2018. Retrieved April 26, 2021.

Schoen, C., Davis, K., Willink, A., and Buttorff, C. 2018. “A Policy Option to Enhance Access and Affordability for Medicare’s Low-Income Beneficiaries.” Commonwealth Fund Issue Brief, September 2, 2018. Retrieved April 26, 2021.

Schoen, C., Willink, A., and Davis, K. 2019. “Medicare Spending Trends 2010-2016: Increase in Prescription Drug Spending More Than Offsets Lower Beneficiary Costs for Other Services.” Commonwealth Fund Issue Brief, November 6, 2019. Retrieved April 26, 2021.

Swagel, P. L. 2019. Re: Budgetary Effects of H.R.3, the Elijah E. Cummings Lower Drug Costs Now Act. Retrieved April 26, 2021.

Willink, A., et al. 2019. “The Financial Hardship Faced by Older Americans Needing Long-Term Services and Supports.” The Commonwealth Fund Issue Brief, January 29. Retrieved April 26, 2021.

Willink, A., and DuGoff, E. H. 2018. “Integrating Medical and Nonmedical Services—The Promise and Pitfalls of the CHRONIC Care Act.” New England Journal of Medicine 378(23): 2153-55. https://doi.org/10.1056/NEJMp1803292.

Willink, A., Reed, N. S., and Lin, F. R. 2019. “Cost-Benefit Analysis of Hearing Care Services: What Is It Worth to Medicare?” The Journal of the American Geriatrics Society 67(4): 784-89. https://doi.org/10.1111/jgs.15757.

Willink, A., et al. 2020. “Dental, Vision, and Hearing Services: Access, Spending, and Coverage for Medicare Beneficiaries. Health Affairs (Millwood) 39(2): 297-304. https://doi.org/10.1377/hlthaff.2019.00451.

Willink, A., et al. 2019. “Financial Stress and Risk for Entry into Medicaid Among Older Adults.” Innovation in Aging 3(4): igz040. https://doi.org/10.1093/geroni/igz040.

Wolff, J. L., et al. 2019. “Medicare Spending and the Adequacy of Support With Daily Activities in Community-Living Older Adults With Disability: An Observational Study.” Annals of Internal Medicine 170(12): 837-44. https://doi.org/10.7326/M18-2467 .