‘Allocating some pay toward financial security pays off in a happier, more stable workforce.’

Generations Today, vol. 43, no. 4 (July-Aug 2022)

‘Allocating some pay toward financial security pays off in a happier, more stable workforce.’

Historically, it has remained difficult for Black and Brown people, particularly those with low incomes, to accumulate wealth, whether through homeownership, small-business ownership or other...

It may be wise to consider retiring outside the climate cone of uncertainty.

The United States has the resources to solve the caregiving problem, it just requires shattering the status quo.

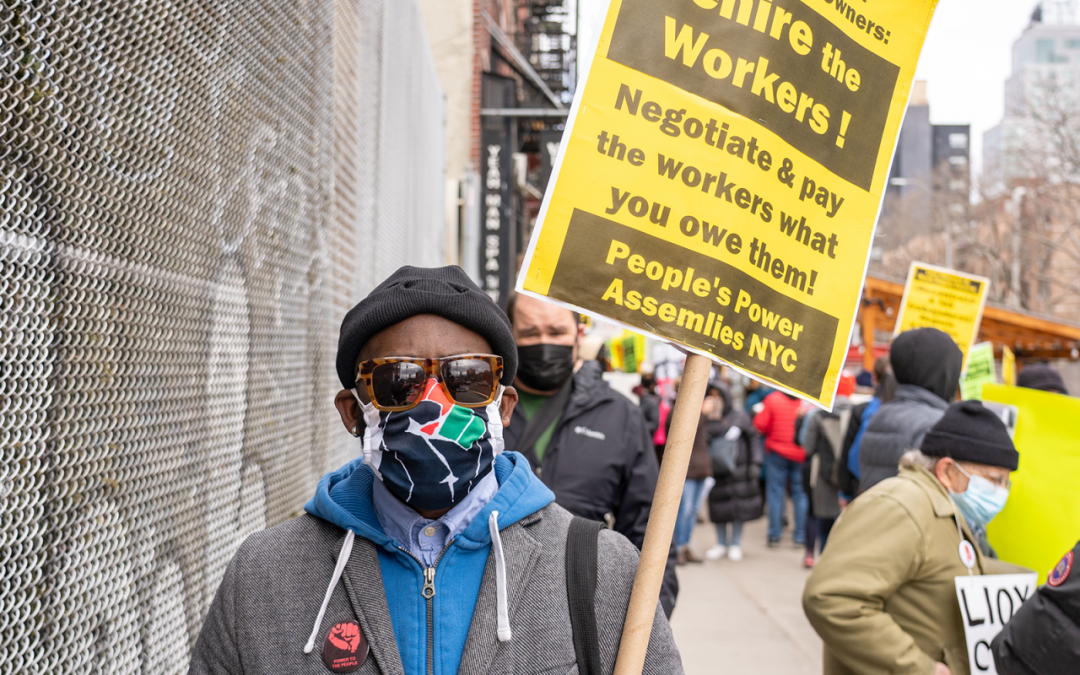

Unionized workers earn more, have better benefits, and have the security of a written contract protecting their rights.

The two stories told of older Americans don’t jibe with reality, which encompasses both scenarios, and everything in between.

NCOA’s call to action to solve a seemingly intractable economic security issue among older adults.

‘Systemic inequities have led to higher poverty rates for people of color, LGBTQ+ older adults and women.’

Generations Today A bimonthly digital publication covering current trends and people impacting the field of aging through OpEds, feature articles, profiles, and first-person pieces.

Generations Today, vol. 43, no. 4 (July-Aug 2022)

To envision the future of the labor market, one of the best places to start is to know that the share of workers ages 55 and older has more than doubled, rising from 12% in 1995 to nearly 25% in 2020. And older workers will fill the majority of new jobs created by...

Historically, it has remained difficult for Black and Brown people, particularly those with low incomes, to accumulate wealth, whether through homeownership, small-business ownership or other investment. Meanwhile, many community-based organizations (CBOs) have...

Pat and Bryant always planned on living near the water in retirement, but they did not plan on this. From their high-rise dream apartment, the 60-somethings watched in disbelief as a torrent of icy water rushed down Boston's Seaport Boulevard. It was January 2018 and...

Caregiving is a silent driver of poverty and inequality for family and professional caregivers. There are more than 40 million Americans who care for an older adult. That family member could be a parent, older sibling or extended family. The average caregiver is a...

Despite America's vast wealth, more than 15 million older Americans—one-third of people ages 65 and older—are “economically insecure,” meaning they are poor or near-poor, according to the National Council on Aging. Half of all Black and Latinx people ages 65 and older...

The complex story of financial security in later life is reflected in competing scenarios presented in the media. A Wall Street Journal piece from March 2022 highlighted the wealth held by older adults and their potential to revive the economy through renewed spending...

The COVID-19 pandemic has laid bare the systemic disparities that leave too many Americans without the resources to age with dignity. For older individuals and their families, being able to afford the necessities of life—shelter, food and healthcare—is essential to...

Economic security means economic justice. Now, more than ever, is the time to act to bring economic stability to millions of older people in or near poverty and redress a legacy of economic inequality so that future generations of older people have greater...